Your AI Features Are Becoming Commodities Faster Than You Can Ship Them

The companies that will lead the next decade aren't adding AI features. They're transforming how value is created—from workflows to decisions (revenue growth today), from dependency to defensibility (protection tomorrow).

We help B2B SaaS companies ($25M-$75M ARR) architect that transformation through:

- Decision Intelligence Strategy

- Proprietary Data Architecture

- Platform Independence

5-minute online assessment

Free 30-minute call

Three Forces Accelerating Commoditization

You're not imagining the pressure. Three simultaneous market shifts are eroding differentiation faster than traditional SaaS companies can adapt—and most won't recognize the pattern until it's too late.

AI-Native Startups

- Born building decisions, not workflows

- 100%+ median growth vs traditional SaaS 23%—that's 4.3x faster

- At $5-20M ARR: 50% vs 30% growth

- No technical debt, no transformation needed

- Setting expectations you must now meet

How AI-Natives are growing so fastCustomer DIY

- Cursor, Lovable, Claude Code enable prototyping

- What took 6 months now takes 6 hours

- 'Why wait for your roadmap?'–An emerging pattern in our 2025 CPO/CTO research

- Customers solving their own pain points

Why the vibe code threat is so dangerousPlatform Providers

- OpenAI, Anthropic learning from usage

- Following AWS 'offer/watch/copy' playbook from 2010-2015

- Building native features from pattern recognition

- Your API calls teach them which features to commoditize next

How OpenAI is learning to replace you

These aren't isolated threats—they're a compounding system. Platform dependency accelerates AI-native competition while customer DIY validates that your workflows are commodity infrastructure."

See the full strategic context →From Daily Symptoms to Strategic Challenges

You're not just experiencing tactical problems. You're experiencing a category shift—and most companies won't recognize it until they've already lost their competitive advantage.

Trust & Adoption Issues

"Customers won't use our AI features"

"Hallucination fears blocking adoption"

Loss of Differentiation

Shared models make features easy to copy

"AI-powered" means nothing

70% launched AI features, only 41% monetizing

Competitive Noise & Parity

"Everyone has AI copilots now"

"Buyers can't tell us apart"

Platform Dependency

Teaching providers your workflows through API calls

Funding intelligence that will obsolete you

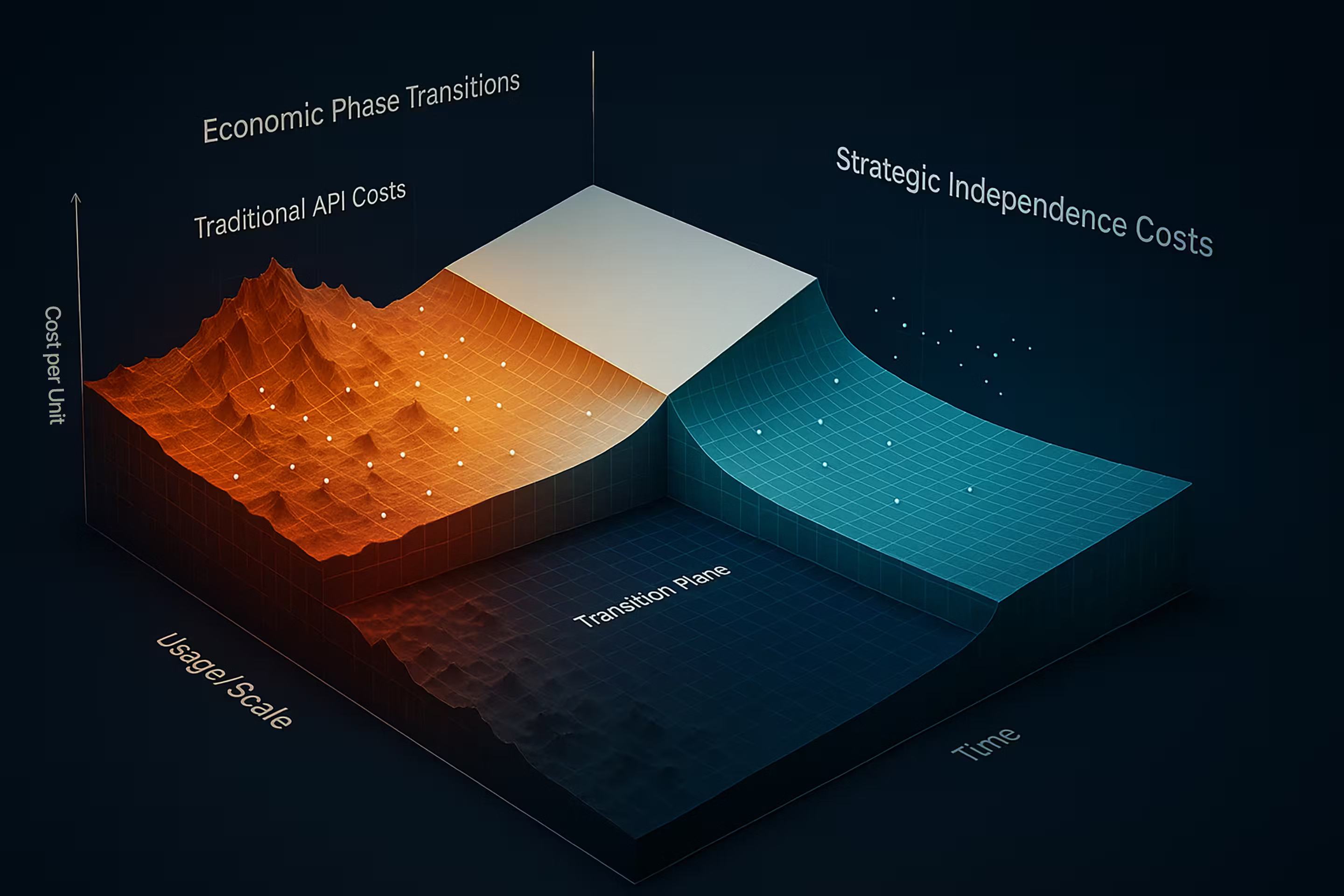

Cost & Control Unpredictability

"API costs rising faster than expected"

"Gross margins declining as AI scales"

Value Erosion

Each new feature costs more to ship but retains less

AI-core and AI-supporting show identical 103% NRR despite 3.25x growth gap—features drive acquisition, not retention

From Workflows to Decisions

For 40 years, software value came from workflow optimization. AI broke that pattern.

Customers no longer want optimized workflows—they want answers, and increasingly, they want software to make decisions for them. This shift requires different architecture, different economics, and different business models.

Workflow Optimization

Software helps people do jobs faster

Example:

CRM helps sales teams manage pipelines

Problem:

Everyone can copy these features

Answer Delivery

Software tells people what to do

Example:

Which prospect to prioritize, which action to take

Gap:

Still requires human execution

Decision Ownership

Software makes decisions and acts

Example:

Auto-qualify leads, adjust pricing, route tickets

Advantage:

Immediate revenue impact (better conversion, faster cycles) + defensible through continuous improvement loops

Workflow Optimization

Software helps people do jobs faster

Example:

CRM helps sales teams manage pipelines

Problem:

Everyone can copy these features

Answer Delivery

Software tells people what to do

Example:

Which prospect to prioritize, which action to take

Gap:

Still requires human execution

Decision Ownership

Software makes decisions and acts

Example:

Auto-qualify leads, adjust pricing, route tickets

Advantage:

Immediate revenue impact (better conversion, faster cycles) + defensible through continuous improvement loops

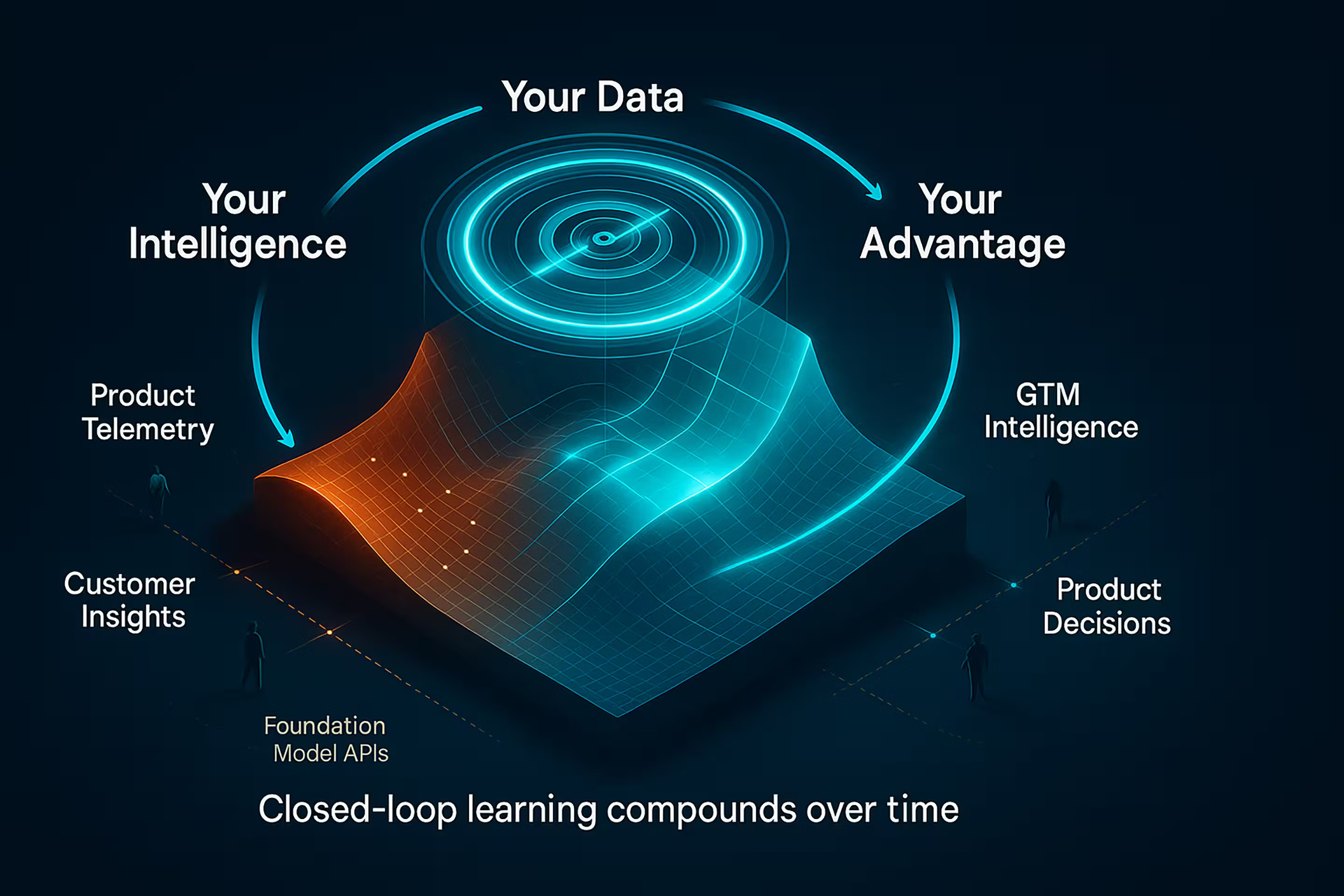

Transformation Pillars

Transformation isn't sequential—it's architectural. But impact follows a clear progression: decision ownership drives revenue growth today, proprietary data creates retention advantages within 6-12 months, platform independence protects margins long-term. These three pillars work together to shift your business model from feature parity to competitive moats.

Decision Ownership

Evolve beyond features to own decision intelligence—better conversion and faster sales cycles from day one.

Open Intelligence Architecture

Strategic model selection + proprietary data moats create advantages AI-natives can't access.

Architected Velocity

Unified intelligence systems that compound over time vs isolated features.

Most companies are adding Level 2 capabilities to Level 1 architecture. That's the paradox.

Andrew Hatfield

Product & GTM Architect, Deepstar StrategicThree Competitive Outcomes

When you transform from workflows to decisions and build on open intelligence architecture, you don't just improve metrics—you fundamentally shift your competitive position. Here's the measurable impact.

Market Leadership

Own Decision Intelligence in Your Category

Transformation positions you as the category leader defining how decision intelligence works in your space—not just another vendor with AI features. This creates three compounding advantages:

- Command premium pricing through unique decision capabilities competitors can't replicate

- Set buyer expectations vs follow them

- Create switching costs through continuous improvement

70% acknowledge competitive pressure from AI implementations, yet 83% with high API dependency rate this risk as low—that gap is where competitive advantages disappear (Deepstar Strategic CPO/CTO Survey 2025)

Cost Efficiency

Strategic Cost Reduction

Platform independence isn't just about risk mitigation—it's about economics that improve as you scale. Strategic architecture choices create measurable cost advantages:

- 20-30% API cost reduction while maintaining or improving performance

- Architectural decisions that reduce dependency without sacrificing velocity

- Predictable, controllable infrastructure economics

Platform independence also protects GTM efficiency. High Alpha's 2025 data shows $20-50M ARR companies have 43% worse CAC payback than $5-20M companies—scaling GTM becomes less efficient without architectural transformation

Defensible Advantage

Proprietary Data Moats

Your data becomes your competitive moat when it feeds intelligence systems only you can access. This creates advantages that strengthen over time:

- Intelligence systems that learn from YOUR customer data, not shared training sets

- Compound learning loops in product AND GTM

- Platform-independent architecture that protects competitive intelligence

Your data trains your advantage, not your replacement

The question isn't whether to add AI. It's whether your AI strategy compounds your advantage or commoditizes it.

Andrew Hatfield

Product & GTM Architect, Deepstar StrategicThis Isn't New—We've Seen This Movie Before

Platform consolidation follows predictable patterns. I've navigated three of these cycles directly—systems engineering through Microsoft's ecosystem consolidation, solution architecture and digital transformation during AWS's infrastructure consolidation, and now AI transformation. The platforms change. The playbook stays constant.

Microsoft did it to ISVs. Google did it to publishers. AWS did it to SaaS companies. Now foundation model providers are following the same playbook—just faster. The difference is whether you recognize the pattern early enough to transform.

Microsoft (1990s)

Embrace, Extend, Extinguish.

- ISVs built on Windows APIs and development tools

- Microsoft observed which applications gained traction

- Built competing products into the OS (Internet Explorer, Office suite)

- Independent software vendors either got acquired or obsoleted

Lesson:

Platform providers learn from their ecosystem, then compete with it.

Google (2000s)

Observe, Control, Monetize.

- Publishers and businesses built traffic through Google search

- Google learned which content and queries drove value

- Kept users on Google properties (Featured Snippets, Knowledge Graph, direct answers)

- Publishers lost traffic and revenue despite creating the content

Lesson:

Platforms capture value created by their ecosystem.

AWS (2010s)

Offer, Watch, Copy.

- SaaS companies built on AWS infrastructure services

- AWS observed which third-party tools customers adopted

- Built native equivalents (OpenSearch, Redshift, Kenesis, monitoring tools)

- Partners either pivoted away or became commoditized

Lesson:

Platform usage patterns reveal market opportunities providers will fill.

AI (2020s - Happening Now, 12-18 Month Window)

Learn, Build Native, Obsolete.

- SaaS companies build on OpenAI/Anthropic APIs

- Foundation providers learn workflows from API usage patterns

- Building native features from pattern recognition (AgentBuilder, Claude Projects)

- Your competitive intelligence funds your replacement

Lesson:

Every API call teaches the platform what features users value most.

30 Years of Platform Cycle Navigation

From government to enterprise to startups—Dell, Red Hat, NetApp, Portworx, Mesosphere. High-stakes, multi-stakeholder transformations where failure isn't an option. Not prediction—recognition. Microsoft, AWS, and now AI—the platforms change, but the playbook stays constant.

Cross-Functional Architecture

15 years engineering and architecture, 10+ years product strategy and GTM. Product strategy without architecture gets features. Architecture without product strategy gets infrastructure. We bridge both.

Pattern Recognition

30 years navigating platform consolidation. Not prediction—recognition. The playbook changes, but the underlying dynamics stay constant.

Market Intelligence

Our research validates what you're experiencing: 70% feel competitive pressure, but 83% have high API dependency with low risk awareness. This gap is where advantages disappear.

Scale + Complexity

100K+ user goverment deployments. Multi-stakeholder enterprise transformations. Fast-moving startup pivots. We've architected solutions where technical excellence, political navigation, and commercial urgency collide.

Let's Discuss Your AI Strategy

30-minute discovery call to explore your AI transformation challenges, competitive positioning, and strategic priorities. No pressure—just a conversation about whether platform independence makes sense for your business.